Everything You Need to Know About Working With a Medicare Supplement Insurance Agent

Medicare has always been a big issue for people. Some even find it intimidating. So, let’s see what the fuss is all about and why you should consider working with a reliable medicare supplement insurance agent when buying insurance.

Pros

of Medicare:

There are countless benefits

that Medicare has brought with it, for example:

· It provides coverage for everyone

Prior to the introduction of

Medicare, over 9 million adults did not have any type of health insurance.

Fortunately, over time, this number has reduced drastically to 500,000 a few

years back. In addition, Medicare also covers many youngers Americans with

disabilities. Without Medicare, these adults would not have healthcare.

Imagine the scenario in which

people looking for major medical insurance in NJ couldn’t have access to

Medicare. Older people, who claim insurance the most, since they are vulnerable

to several diseases and disorders, would have to pay a ridiculous amount of

money for treatments and medications. People with disabilities would have to

entirely depend on their caretakers.

Thus, it is evident why

Medicare is so crucial in today’s world.

· It cost very little relatively when compared with the benefits

The thing about Medicare is

that it is divided into several parts, so everyone can find something to help

them. Medicare enrollees qualify for Part A for free. Though, you might have to

pay a small amount of money every month as a premium for Part B. When you

compare this small premium with the costs of operations, medications, and other

costs associated with it, you can save yourself a considerable sum.

· Medicare advantage for additional coverage

More people have been opting

for the advantage plan every day, and the trend is not going to stop anytime

soon. Enrollment has seen a massive surge, almost quadrupling from 5.3 million

to 22 million in the last 16 years. People enrolling for Part C (Medicare

Advantage) made up the majority.

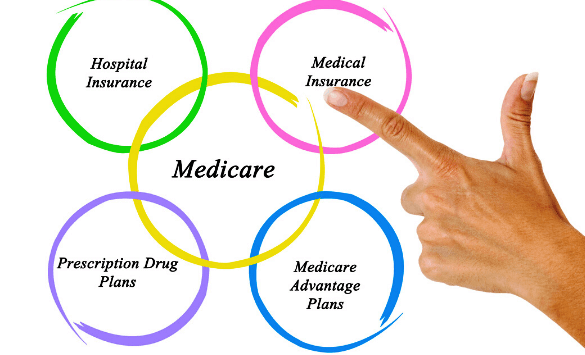

If it is getting a little

confusing, here is the simple breakdown. Part A (Hospital Insurance) and Part B

(Medical Insurance) are together collectively called ‘Original Medicare’. Plan

C (Medicare Advantage) can provide you with additional coverage, such as

dental, vision, etc., at a minimal cost.

· It led to prescription innovations

Medicare provided a level playing

field for all the private drugmakers to provide all the citizens with

prescriptions they didn’t have access to before. Private pharmaceutical

companies have spent and continue to spend billions of dollars every year to

develop new drugs that can improve the quality of life. In addition, Part D

(Prescriptions drugs plan), which can be sold through private insurance

companies and agents, had increased the number of options of prescription

medicines available to American citizens significantly. It also creates a

competitive market for pharmaceutical companies and insurance providers, thus

driving their prices down. This benefits the people.

· Increased medical standards

Due to Medicare, people

looking for major medical

insurance in NJ have increased tremendously. To cater to the vast

demand, companies have improved the quality of their services and products. In

addition, accountability and government oversight have also persuaded companies

to strictly follow the regulations and provide the citizens with the best

medical care possible.

Why

work with a medicare supplement insurance agent?

While the vast number of

products and insurance packages have given people a large variety to choose

from, it has also created mass confusion. Most people have regular jobs. Hence

they might be uninformed about each aspect of the insurance and how it can benefit

or harm them. Buying yourself the right insurance is a crucial task as every

intricate detail about it can have a significant consequence in the future.

That’s why you need a professional with years of knowledge, experience, and

skills to help you make the right decision. That’s why so many people prefer to

work

with a reliable medicare supplement insurance agent. Such an

agent can also understand your needs, requirements, objective, and budgets to

help you buy the insurance that suits you the most.

In addition, an agent works

with several different insurance providers. So, they are able to provide you

with a variety of options for you to choose from. Also, many people prefer

human touch when making crucial decisions rather than seeking help from an Artificially

Intelligent chatbot.

Fortunately, you can connect

yourself with a trusted agent in a couple of minutes, thanks to the internet

and the power of technology. Just a few taps on your smartphone, and you are

good to go!

Comments

Post a Comment